Sullivan Tire is getting significant new revenue from underperforming customers and winning a second sale from one-time buyers by making more relevant offers in direct mail campaigns. The relevancy comes from using customer transaction data and customer analytics to develop the necessary variable information for highly personalized postcards.

Sullivan Tire (ST) is a family-owned regional chain of auto service centers with over 80 locations in the Northeast United States. Founded in 1955, corporate values emphasize a commitment to family and community, including treating customers as members of the family. Broadcast marketing, especially TV spots associated with the Boston Red Sox, are used to build the ST brand.

They have a rich set of transactional data including a customer’s car make, model, model year, mileage, and tire tread depth which are used to trigger mailings for services such as oil changes, state inspections, tire rotations and alignments. However, the data needs to be worked for good returns. Sullivan’s messaging positions the service centers as hometown providers, as problem solvers with a trusted relationship with their customers. Their strategy is to solidify this messaging with multi-touch direct marketing campaigns.

The challenge for a direct marketing campaign is that while the historical data has great potential, customer behavior varies widely. ‘Spray and pray’ tactics (sending everyone the same marketing message) don’t generate sufficient response. Sullivan was seeking a holistic approach rather than a store-by-store approach with the ability to reach the customer when they are ready to buy. To do this, ST needed better insight into their customers’ behaviors.

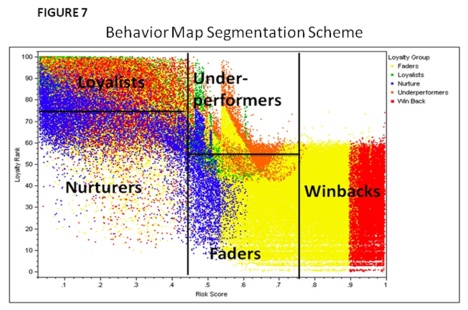

Loyalty Builders analyzed the ST transaction data with particular emphasis on two proprietary metrics, Risk Score and Loyalty Rank. A customer’s Risk Score is the probability that the customer will not buy again in the next year. Loyalty Rank is a measure of the value of a customer to the business, incorporating how much the customer has spent, what products were purchased, how the time between purchases is changing, plus several other factors.

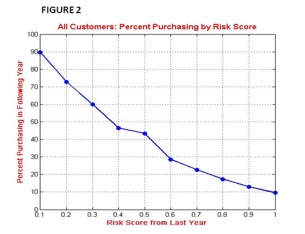

Figure 1 shows how Risk Score in the previous year correlates with percent of customers making purchases in the following year. High Risk Score leads to low likelihood of purchase in the following year.

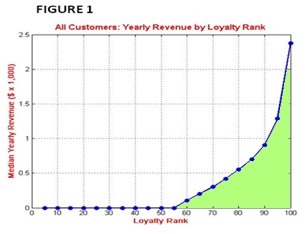

Figure 2 shows the relationship between Loyalty Rank and median revenue. As expected, customers with higher Loyalty Rank contribute more revenue. What counts here is the shape of the curve, because total revenue is directly proportional to the area under the curve. To get more total revenue, marketing activities must focus on the middle Loyalty Ranks to move the curve up and to the left across several Loyalty Ranks; it is not enough to campaign only to the higher Loyalty Ranks.

When the full analysis was done, two subsets of the customer population stood out as needing attention, underperformers and one-time buyers.

Underperformers are previously high ranked customers who have fallen off those heretofore good purchase patterns. The large number of one-time buyers is problematical because their single purchase may not generate enough gross margin to cover the cost of acquisition.

To bring the underperformers back to more active purchasing, ST engaged Loyalty Builders to undertake an extended direct mail campaign, sending mailings on a monthly basis to underperforming customers who were predicted to be winnable. Different customers fell into this bucket each month.

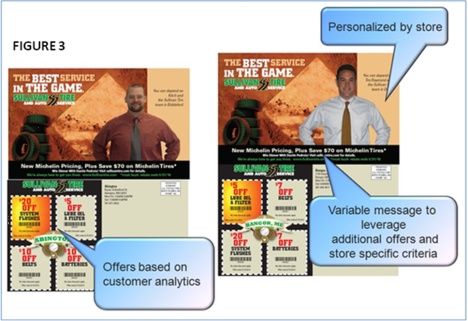

The mailings were highly personalized with four coupons for each customer. Coupons were offered to customers depending on the up-sell probabilities and cross-sell affinities that had been calculated for that customer. The offered discount for each coupon depended on a customer’s Loyalty Rank and Risk Score. The collateral also showed a photo of the branch manager at the ST location closest to the customer’s home, part of the strategy to emphasize the manager as a “trusted advisor”.

Figure 3 shows images of typical personalized and relevant postcards.

This was a true one-to-one marketing campaign making cost-effective use of variable information. By partnering with Loyalty Builders, ST was able to execute such an advanced campaign even with limited marketing resources.

Sullivan Tire believes that the results from this extended campaign have been excellent:

Figure 7 shows the behavior map of the Sullivan Tire customer population.

Each dot is a uniquely identifiable customer, with three data values shown:

What is striking about this chart, the result of a solid year of work, is the large number of customers who were formerly in the Underperformers segment (orange dots) who have now moved up and to the left into higher Loyalty Ranks and lower Risk Scores.

The challenge is to win the second sale from a large population of generally unprofitable one-time buyers. At ST, an active customer is someone who has made a purchase within the last two years, and 41% of them are one-time buyers. Over one quarter of total revenue in the past twelve months comes from these one-timers. This is an important subset of the customer population.

To get a second sale, Loyalty Builders used a three-step process:

After carrying out these three steps, ST and Loyalty Builders knew which customers to approach, when to contact them, and what to offer. Here’s how it was done.

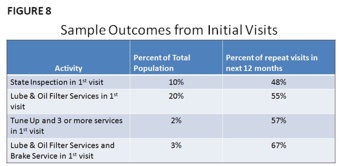

First, Loyalty Builders studied the initial purchases to learn which ticket items most often led to a second visit. Some of these activities are listed in Figure 8.

Using data like this, analysis identified which one-time buyers were best candidates to return for a second visit.

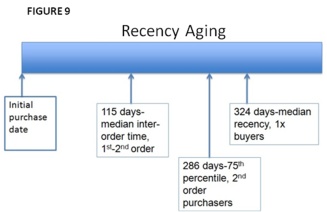

Next, Loyalty Builders studied the recency patterns of one-time buyers and of customers who made multiple visits. Half of all customers making a repeat visit do so within four months (actually, 115 days), and 75% of them make that second visit within 286 days. By contrast, half of the one-timers made their only purchase almost a year ago (324 days). This data is displayed graphically in Figure 9.

Normal campaigning is appropriate between the initial purchase date and 115 days thereafter. In that period, half of the customers who will eventually make a second sale will do so. Past that 115 day mark, there is increasing urgency to secure the crucial second sale. The window for a concerted push is between 115 days and 286 days, by which time, three quarters of those who will return have done so. Every month, a different set of our selected customers falls within this window, making them new campaign targets.

Purchase ticket analysis tells who among the one-timers are good targets, and recency analysis reveals when to send the campaign. What to offer is again determined by up-sell probabilities and cross-sell affinities. Since the already-purchased list of products is relatively short, there are not a lot of up-sell opportunities and cross-sell plays a more important role in the one-time buyer program. Direct mail is again the media of choice, with aggressive discounts on some items. Half of the coupons are for cross-sell.

At the time of this case study write-up, the one-time buyer campaign is in its early stage, with only a few months of data. Results are extremely encouraging. Control group response rate is 1.5%, while the targeted group is responding at 2.5%, a 67% lift. While the overall numbers are relatively small, these are customers who otherwise never would have made a second purchase. Postcard costs are low, even using the variable information, and the ROI on the campaign is very good.

Despite the limited marketing resources, Sullivan Tire is executing sophisticated, true one-to-one campaigns with variable information that is driving significant revenue from underperforming customers and one-time buyers. Targeted customers are buying more services. The key to this success is the use of variable information from customer analytics to make more relevant offers.